Introduction

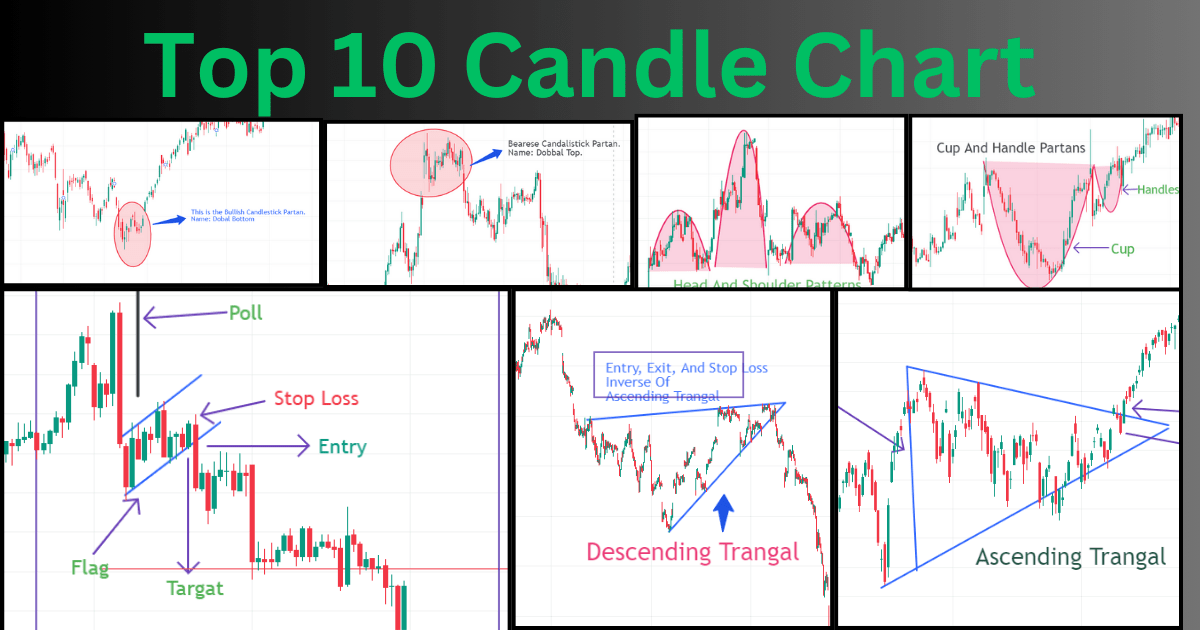

Candlestick chart patterns are an essential tool for traders and investors in the financial markets. These patterns provide valuable insights into market sentiment and help predict future price movements. understanding and mastering these top 10 candle chart patterns, you can gain a competitive edge in your trading strategies.

Types Of Candle chart Patterns :

Divided it into 3 parts Likes.

- Bull Reversal Patterns

- Bearish Reversal Patterns

- Continuation Patterns

I. Bull Reversal Patterns

A. Flag and Pole Pattern

1. Definition and Characteristics

The flag and pole pattern is a bullish reversal pattern that resembles a flag flying on a flagpole. It typically occurs after a strong upward price movement, followed by a brief period of consolidation. This consolidation forms the flag, while the initial upward movement forms the pole.

2. How to Identify and Confirm the Pattern

To identify and confirm the flag and pole pattern, look for the following characteristics:

- A strong and rapid price increase, forming the pole

- A consolidation period characterized by parallel trend lines, forming the flag

- Volume contraction during the consolidation phase

- A breakout above the flag’s upper trendline, indicating a potential bullish continuation

3. Potential Trading Strategies

Once you have confirmed the flag and pole pattern, you can implement the following trading strategies:

- Enter a long position above the breakout level

- Place a stop-loss order below the flag’s lower trendline

- Set a profit target based on the length of the flagpole or previous resistance levels

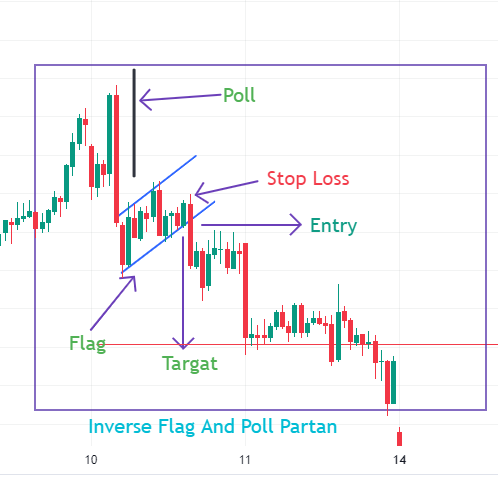

B. Inverse Flag and Pole Pattern

1. Definition and Characteristics

The inverse flag and pole pattern is the bearish counterpart of the flag and pole pattern. It typically occurs after a strong downward price movement, followed by a period of consolidation. The consolidation forms the inverse flag, while the initial downward movement forms the pole.

2. Recognizing the Pattern’s Reversal Signal

To recognize the reversal signal of the inverse flag and pole pattern, pay attention to the following characteristics:

- A sharp and rapid decrease in price, forming the pole

- A consolidation phase with parallel trend lines, forming the inverse flag

- Volume contraction during the consolidation period

- A breakdown below the lower trendline of the inverse flag, indicating a potential bearish continuation

3. Tactical Approaches for Effective Trading

Once you have identified the inverse flag and pole pattern, you can employ the following tactical approaches for effective trading:

- Enter a short position below the breakdown level

- Place a stop-loss order above the inverse flag’s upper trendline

- Set a profit target based on the length of the pole or previous support levels

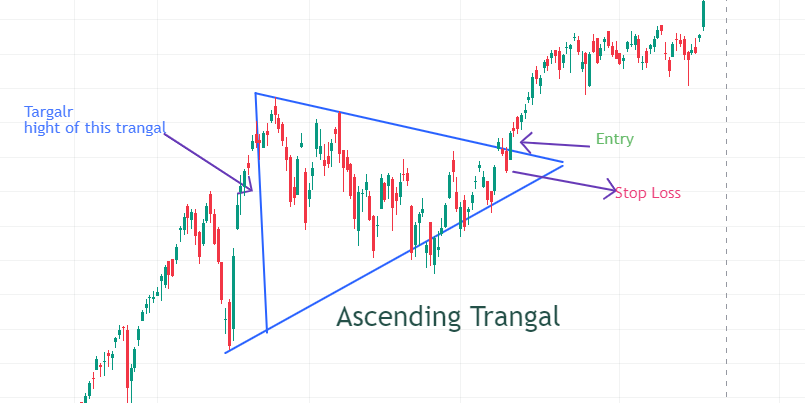

C. Ascending Triangle Pattern

1. Understanding the Significance of this Bullish Pattern

The ascending triangle pattern is a bullish continuation pattern that represents a period of consolidation within an uptrend. It is formed by a series of higher lows and horizontal resistance levels. This pattern indicates that buyers are gaining strength and an upward breakout is likely.

2. Determining Entry and Exit Points

To determine entry and exit points when trading the ascending triangle pattern, consider the following:

- Enter a long position above the breakout level, which is the horizontal resistance line

- Place a stop-loss order below the most recent swing low within the triangle

- Set a profit target based on the height of the triangle added to the breakout level

3. Leveraging Ascending Triangle Patterns in Trading

When leveraging ascending triangle patterns in your trading, keep the following tips in mind:

- Look for volume confirmation during the breakout to increase the probability of the pattern’s success

- Take into account the overall market condition and the presence of any major news events that may affect the pattern’s validity

- Monitor for false breakouts, which may occur when the price briefly moves above the resistance line but fails to sustain the upward momentum

II. Bearish Reversal Patterns

A. Head and Shoulders Pattern

1. Recognizing the Three Peaks and their Implications

The head and shoulders pattern is a bearish reversal pattern that consists of three peaks: the left shoulder, the head, and the right shoulder. It indicates a potential trend reversal from bullish to bearish. The pattern is formed when an uptrend reaches a peak (head) and subsequent pullbacks create the left and right shoulders.

2. Analyzing Volume and Breakout Confirmations

To analyze volume and breakout confirmations when trading the head and shoulders pattern, consider the following:

- Volume should be higher during the left shoulder and head formation and lower during the right shoulder

- A breakout below the neckline, which connects the lows of the shoulders, confirms the pattern’s validity

3. Implementing Trading Strategies for Maximum Benefit

When implementing trading strategies for the head and shoulders pattern, keep the following in mind:

- Enter a short position below the neckline breakout level

- Place a stop-loss order above the right shoulder

- Set a profit target based on the pattern’s height projected downward from the neckline

B. Inverse Head and Shoulders Pattern

1. Defining the Pattern’s Characteristics

The inverse head and shoulders pattern is the bullish counterpart of the head and shoulders pattern. Its patterns reversal from bearish to bullish. The pattern is formed when a downtrend reaches a low (head) and subsequent rebounds create the left and right shoulders.

2. Identifying Entry and Exit Signals

To identify entry and exit signals when trading the inverse head and shoulders pattern, consider the following:

- Enter a long position above the neckline breakout level

- Place a stop-loss order below the right shoulder

- Set a profit target based on the pattern’s height projected upward from the neckline

3. Practical Tips for Trading using Inverse Head and Shoulders

When trading using the inverse head and shoulders pattern, consider the following practical tips:

- Look for volume confirmation during the neckline breakout to increase confidence in the pattern

- Take into account the overall market condition and the presence of any major news events that may affect the pattern’s validity

- Monitor for false breakouts, which may occur when the price briefly moves above the neckline but fails to sustain the upward momentum

C. Cup and Handle Pattern

1. Understanding the Structure of the Pattern

The cup and handle design is a bullish continuation design that looks like a cup with a handle. It demonstrates a transitory delay in an upturn prior to continuing its vertical development. The example comprises of an adjusted base (cup) trailed by a more modest union (handle).

2. Confirming Breakouts and Reversal Points

To confirm breakouts and reversal points when trading the cup and handle pattern, consider the following:

- Look for a breakout above the handle’s resistance level, which signals a potential bullish continuation

- Confirm the pattern’s validity by ensuring the retracement (handle) does not exceed 50% of the cup’s range

3. Tips for Profitable Trading with Cup and Handle Patterns

When trading with cup and handle patterns, keep the following tips in mind:

- Enter a long position above the handle breakout level

- Place a stop-loss order below the cup’s low

- Set a profit target based on the pattern’s height projected upward from the breakout level

III. Continuation Patterns

A. Descending Triangle Pattern

1. Identifying the Pattern’s Downtrend Signals

The descending triangle pattern is a bearish continuation pattern that represents a period of consolidation within a downtrend. It is formed by a series of lower highs and horizontal support levels. This pattern indicates that sellers are gaining strength and a downward breakout is likely.

2. Analyzing Volume and its Role in Confirmation

To analyze volume and its role in confirming the descending triangle pattern, consider the following:

- Volume should show a contraction during the consolidation period

- A breakout below the horizontal support line confirms the pattern’s validity

3. Capitalizing on Descending Triangle Patterns

To capitalize on descending triangle patterns, consider the following strategies:

- Enter a short position below the breakout level

- Place a stop-loss order above the most recent swing high within the triangle

- Set a profit target based on the height of the triangle projected downward from the breakout level

B. Inverse Cup and Handle Pattern

1. Definition and Key Characteristics

The inverse cup and handle pattern is the bullish counterpart of the cup and handle pattern. In this patterns trend are reversal from bearish to bullish. The pattern consists of a rounded top (cup) followed by a smaller consolidation (handle).

2. Recognizing Key Breakout Patterns

To recognize key breakout patterns when trading the inverse cup and handle pattern, consider the following:

- Look for a breakout above the handle’s resistance level, which signals a potential bullish reversal

- Confirm the pattern’s validity by ensuring the retracement (handle) does not exceed 50% of the cup’s range

3. Optimizing Trading Strategies using Inverse Cup and Handle

When optimizing trading strategies using the inverse cup and handle pattern, keep the following in mind:

- Enter a long position above the handle breakout level

- Place a stop-loss order below the cup’s high

Set a profit target based on the pattern’s height projected upward from the breakout leve

C. Consolidation Pattern (Sideways Channels)

1. Understanding Sideways Movement and Consolidation

The consolidation pattern, also known as sideways channels, represents a period of indecision and balance between buyers and sellers. It occurs when the market remains range-bound, with horizontal support and resistance levels containing price action.

2. Interpreting Resistance and Support Levels

To interpret resistance and support levels within the consolidation pattern, consider the following:

- Resistance levels act as barriers, preventing the price from moving higher

- Support levels act as floors, preventing the price from moving lower

- Pay attention to the number of times price touches these levels to determine their significance

3. Trading Opportunities within Sideways Channels

Within sideways channels, look for the following trading opportunities:

- Buy almost near to the support level and sell near the resistance level

- Stop-loss should be place below the support level or above the resistance level

- Take profit when the price approaches the opposite boundary of the channel

IV. Conclusion

In this comprehensive blog post, we have covered the top 10 candlestick chart patterns that are essential for traders and investors in technical analysis. These patterns include bull reversal patterns like the flag and pole pattern, inverse flag and pole pattern, and ascending triangle pattern. We also discussed bearish reversal patterns such as the head and shoulders pattern, inverse head and shoulders pattern, and cup and handle pattern. Lastly, we explored continuation patterns like the descending triangle pattern, inverse cup and handle pattern, and consolidation pattern.

FAQ

What is the purpose of an “Ascending Triangle” pattern in technical analysis?

An Ascending Triangle pattern in technical analysis serves as a bullish continuation pattern, indicating a potential resumption of an ongoing uptrend. It is formed by a horizontal resistance line and an ascending support line, creating a triangle shape

How does a “Double Bottom” pattern differ from a “Double Top” pattern?

A “Double Bottom” is a bullish reversal pattern that forms after a downtrend, characterized by two troughs at roughly the same price level, separated by a minor peak. In contrast, a “Double Top” is a bearish reversal pattern formed after an uptrend, featuring two peaks at approximately the same price level, separated by a minor trough.

What is the significance of a “Cup and Handle” pattern in technical analysis?

The “Cup and Handle” pattern is a bullish continuation pattern that suggests a potential upward price movement. It consists of a rounded bottom (cup) followed by a consolidation (handle) before a potential breakout. Traders often view this pattern as a signal for a resumption of the previous uptrend.

In financial markets, what does the term “Flag and Pole” refer to?

Flag and Pole” is a continuation pattern where a strong price movement (pole) is followed by a rectangular consolidation (flag). This pattern typically indicates a brief pause before the resumption of the previous trend, be it an uptrend or a downtrend.

How can a trader interpret a “Head and Shoulders” pattern?

A “Head and Shoulders” pattern is a trend reversal pattern. It consists of three peaks: the central peak (head) is higher than the surrounding peaks (shoulders). This pattern often signals a potential shift from a bullish to a bearish trend or vice versa, depending on its orientation.