I. Introduction:

In the exciting world of finance, the question often arises: How much money do you need to start option buying? Well, here’s the fascinating part – you can kick start your journey with just 30000! This article delves into the significance of having a minimum capital for option buying and explores smart strategies to make the most of your 30000 investment.

II. Understanding the Significance of Minimum Capital:

The term “minimum capital required in option buying” is not just a mouthful; it’s the key to opening doors for a broader audience of aspiring traders. Let’s break down why starting with a modest 30000 is a game-changer.

A. Advantages of Starting with 30000:

- Accessible Entry Point: The phrase “minimum capital required” is like the golden key that unlocks the door to option buying. Starting with 30000 makes it accessible to more traders, creating a level playing field.

- Risk Mitigation: The magic of minimum capital lies in reducing risk. It’s akin to having training wheels while learning to ride a bike – it allows traders to gain valuable experience without the fear of a significant financial fall.

- Flexibility in Decision-Making: Minimum capital provides the flexibility to make strategic decisions. Think of it as having multiple paths to choose from in a maze. With 30000, traders can adapt to market conditions without feeling financially constrained.

B. Strategic Utilization of a 30000 Capital:

Now that we’ve established the importance of having a minimum capital, let’s explore how you can strategically utilize your 30000 for successful option buying.

1. Diversification Magic

- Spread Your Wings: The concept of “minimum capital required” aligns perfectly with diversification. Think of it as spreading your investment wings across different options, much like exploring different flavors of ice cream.

2. Picking the Right Options

- Choose Wisely: The crux of “minimum capital for option buying” lies in making informed choices. It’s about selecting options that resonate with your preferences, similar to picking your favorite candy. Do your homework to make wise decisions.

3. Be a Risk Management Superhero

- Set Safety Rules: Minimum capital doesn’t mean minimum safety. Be a superhero in risk management by setting rules – it’s like wearing a helmet while riding your financial bike. Use stop-loss orders and avoid putting all your eggs in one basket.

4. Ride the Volatility Roller coaster

- Enjoy the Ride: Market volatility can be your friend when you have minimum capital at your disposal. It’s like enjoying a roller coaster ride – sometimes fast, sometimes slow. Jump on the ride at the right time with your 30000!

5. Keep Learning and Have Fun

- Be a Detective: The journey of minimum capital for option buying is an adventure. Be a detective, continuously learning about the market, trends, and strategies. Make yourself more skillful.

C. Pros:

- Accessibility to a broader audience.

- Risk mitigation with lower capital.

- Increased flexibility and adaptability.

- Learning opportunities with modest capital.

- Diversification potential.

D. Cons:

- Limited profit potential.

- Reduced margin for error.

- Risks in market volatility.

- Constraints on strategic options.

- Emotional impact and impulsivity risks.

- Potential for under capitalization.

III. Conclusion: Making the Most of Minimum Capital:

To sum it up, having a “minimum capital required in option buying” is not a limitation; it’s an invitation to an inclusive and adaptable trading adventure. Use your 30000 wisely, explore different options, and watch your investments grow with careful planning.

IV. Frequently Asked Questions (FAQs)

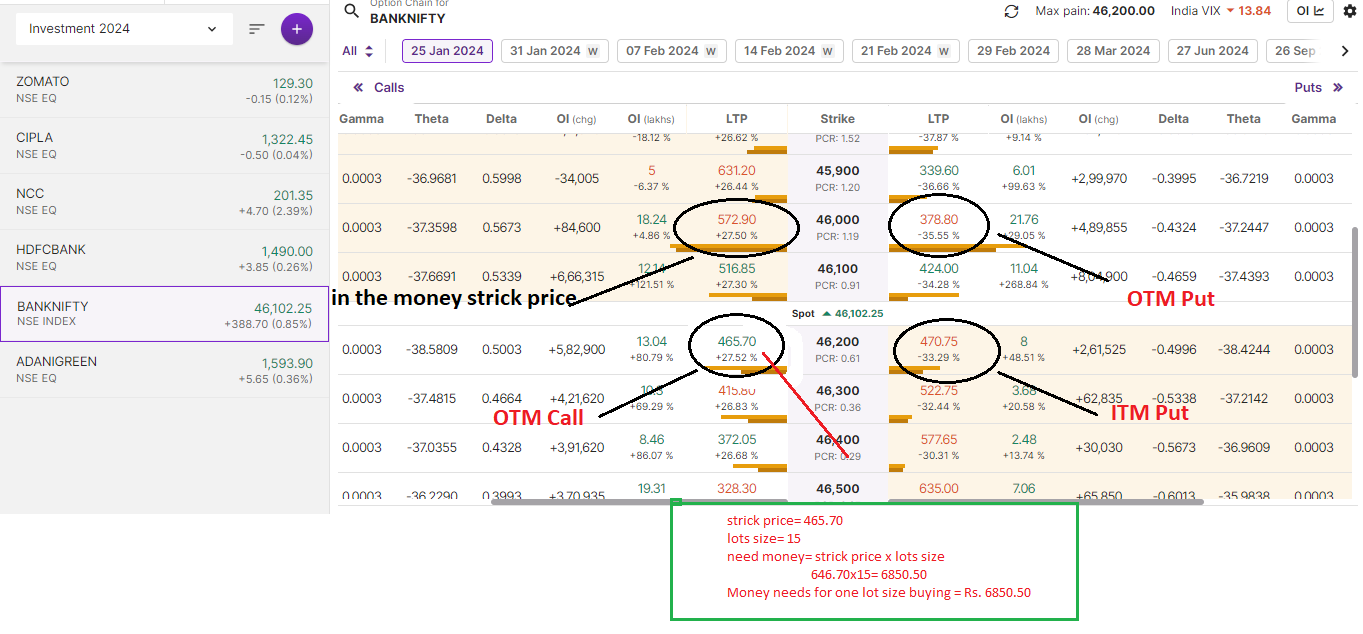

What is the minimum capital required for option buying?

The minimum capital required is 30000, making option buying accessible to a broader audience

How can I set safety rules with a 30000 capital?

Setting safety rules with 30000 is crucial, like wearing a helmet while riding a bike. Use stop-loss orders and avoid putting all your money in one place.

Can I start option trading with 1000 rupees?

Yes, you can trading in option with the 10000 rupees only a signal lots in Nifty and Bank Nifty. You can not selling option, you only buying in option.

Can I trade options less than 100?

Yes, sometimes you can trade options in amounts less than 100. This is called trading “mini-options.” However, it depends on your broker and the exchange rules. Check with your broker to see if they allow trading in smaller quantities of options contracts.

Can I start option trading with 5000 rupees?

Absolutely! Yes, diving into option trading with 5000 rupees is doable. Just keep in mind, take it slow, learn the ropes, and choose strategies that fit your budget. Stay updated on market happenings, and, of course, be smart about managing risks. Happy trading!

I like the helpful information you supply in your articles.

I will bookmark your weblog and test again right here frequently.

I’m moderately sure I will be told a lot of new stuff proper here!

Good luck for the following!